Ask an Attorney a Question for FREE!

The Declarations Page

Part II - Example

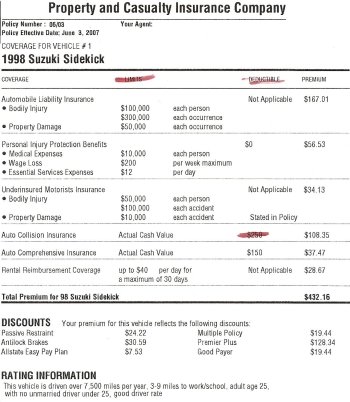

The following page of the Declarations Page contains the coverage attributed to each vehicle. In the case of the prior section, the first vehicle was a 1998 Suzuki Sidekick, and second vehicle is a 2005 Honda Accord.

Above, you can see actual coverages listed. In this particular policy, the coverages for both vehicles are the same. Your policy could be very different.

Coverages are attached to a particular vehicle and NOT TO A DRIVER (insurance follows the car, for the most part).

This policy has Liability limits of 100,000/300,000 for bodily injury.

This means that if you hurt someone in a car accident, then the injured person will be covered up to 100,000. If you hurt two people, then each will be covered up to $ 100,000 ($200,000).

If there is a third person injured, then the same logic applies, $100,000 of coverage for that third person (total of $300,000). But the second limit kicks in at $300,000.

The insurance company will pay the maximum of $300,000 regardless of how many people are in the vehicle. It is a double limit.

The declaration page also shows a limit for property damage.

In this case, the most the insurance company will ever pay is $50,000. If the insured hits a house, or a very expensive chopper, then anything above and beyond $50,000 will come out of the insured’s pocket!

Note that there is no deductible for liability coverage.

The words “not applicable” appear under this heading. This means the insurance company will pay 100% of the damages up to their liability limit.

You do not have to pay anything for anybody’s damage or injury (as long as the total damage is below your limits). Read more about Liability Coverage.

The next heading is Personal Injury Protection Coverage. Here the declaration page sets all the limits and terms that will govern the auto insurance policy.

In this case, medical expenses will be covered up to $10,000 per person.

There are no limits on how many people can be covered or a maximum dollar amount per accident, unlike in the Liability Coverage where double limits are specified.

Note that there is no deductible noted. Again, the insurance company will pay 100% of the medical expenses you incurred up to $10,000. Read more on Personal Injury Protection Coverage.

The next coverage is Uninsured or Underinsured Motorist Coverage. It shows limits for that coverage. Here the limits apply to each person or each accident depending on which coverage you are seeking (property damage v. injury claims).

The declarations page then moves into First Party Coverages or coverages to your auto.

Collision, Comprehensive, and Rental Coverages are outlined. The deductibles and limits that will apply depend on the type of loss or claim that you have.

Note that the coverages to your car are only covered at ACTUAL CASH VALUE. This means that they will depreciate your car to its current fair market value, not to what you actually paid for.

It is important to remember that the declarations page does not define anything or explain duties and/or the responsibilities of the parties.

These duties and responsibilities are explained in the policy jacket (the main portion of the auto policy). If you do not understand your declarations page, then you cannot read the sections that apply to you!

Learn How to Read Your Auto Insurance Policy

Auto Policy Declarations Page

Auto Dec. Page II

The Auto Policy Part I

The Policy Part II

Read Your Policy Endorsements

|

|

|

For a Free Review of Your Case

Please Call (866) 878-2432 |